Streamline Your Business Finances

Complete access to 75+ lenders nationwide with our simple application process.

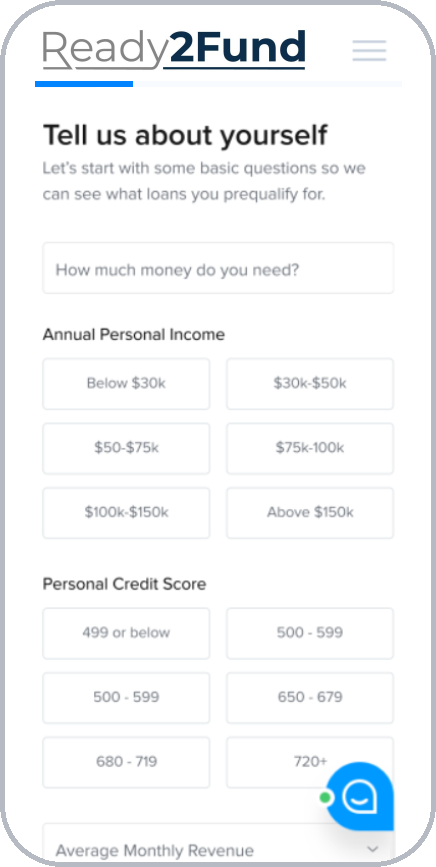

Check Your Business’s Financing Eligibility Today!

Match and discover

your lender

1

Apply fast.

Apply in a minutes! Checking your eligibility won’t impact your credit.

2

Get connected.

Our funding manager will contact you for your business needs.

3

Compare offers.

Ready2Fund’s 75+ lender network delivers rapid access to custom funding.

4

Get funded.

Choose an offer and receive funding for your business within 24 hours.

Small business loan types at Ready2Fund

Fuel your business growth with the perfect loan. Fast and easy pre-qualification in minutes matching you with the best lender in our loan market place.

Accounts Receivable Financing

Obtain immediate liquidity by monetizing your purchase orders or accounts receivable, allowing you to continue normal business operations.

Loan Amount

Tied to receivables

Speed of Funds

as soon as 24hrs

Interest Rate

as low as 3%

Business Line of Credit

Obtain a flexible credit line that allows you to borrow funds as needed and repay them at a later time.

Loan Amount

$1k-500k

Speed of Funds

1-2 days

Interest Rate

8%-60%

SBA Loan

Encompass a wide range of aspects for your small business. Some of the most commonly used SBA loans include the 7(a), 504, and SBA Express programs.

Loan Amount

up to $5M

Speed of Funds

1-3 months

Interest Rate

Prime+

Short Term Loan

Employ it to manage unforeseen expenses, weather a downturn, fund a brief project, or seize a new business venture.

Loan Amount

$2.5k-500k

Speed of Funds

as soon as 24hrs

Interest Rate

as low as 8%

Business Term Loan

A term loan grants a single disbursement of funds that is paid back through scheduled payments over a predetermined period, known as the loan’s term.

Loan Amount

$5k-2M

Speed of Funds

as soon as 24hrs

Interest Rate

as low as 6%

Business Cash Advance

A cash advance provides businesses with rapid access to capital by allowing them to borrow against their future earnings, with repayment made through a predetermined daily percentage of sales.

Loan Amount

$5k-1M

Speed of Funds

as soon as 24hrs

Interest Rate

as low as 18%

Equipment Financing

Utilize this loan to acquire any type of equipment necessary for your business operations. Financing solutions are available for almost every sector and for any sort of item your business requires.

Loan Amount

$5k-1M

Speed of Funds

as soon as 24hrs

Interest Rate

as low as 7.5%

Commercial Mortgage

Apply it to acquire, construct, enlarge, renovate, or refinance your business premises.

Loan Amount

$5k-5M

Speed of Funds

1-3 months

Interest Rate

as low as 4.5%

Startup Loan

Invest in your own business by retaining full ownership. Instead of forfeiting equity to investors, a startup loan provides the necessary working capital to help your startup grow without sacrificing ownership.

Loan Amount

up to $150k

Speed of Funds

2-4 weeks

Interest Rate

up to 31%

Business Acquisition Loan

Acquire an established business or franchise, seizing business opportunities that arise even if you lack the capital to buy it outright.

Loan Amount

$5k-5M

Speed of Funds

as soon as 30 days

Interest Rate

as low as 5.5%

Business Credit Card

A business credit card assists in monitoring expenditures, establishing a robust business credit profile, and enhancing your working capital, thus enabling you to earn tangible benefits.

Loan Amount

up to $150k

Speed of Funds

2-4 weeks

Interest Rate

up to 31%

Client Testimonials

Hear What Our Clients Have to Say About Us

Connect with us today

We are here to help you with any inquiries you may have about our products and services.

We look forward to hearing from you!